On August 16, 2022, President Joe Biden signed the Inflation Reduction Act of 20222 (IRA) into law. The new legislation makes the greatest investment in climate change mitigation in American history.

One of the major provisions of the IRA is about investments in climate change and energy security. This provision deals with a number of climate protection expenditures, such as tax credits for households to offset energy costs, investments in clean energy generation, and tax credits intended to lower carbon emissions.

The IRA offers two distinct sets of rebates, which are essentially upfront discounts on equipment and are weighted to benefit individuals with lower incomes the most.

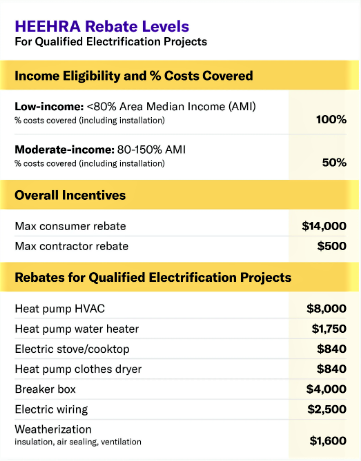

The High-Efficiency Electric Home Rebate Act (HEEHRA)

The High-Efficiency Electric Home Rebate Act (HEEHRA) is part of the Inflation Reduction Act of 2022 which provides $225 million for tribal governments to disperse, along with $4.275 billion in rebate money that will be allocated by state energy offices. It is a 10-year rebate program designed for low- to moderate-income (LMI) households that entices homeowners to shift to electric home appliances and systems.

The HEEHRA provides point-of-sale consumer discounts to enable low- and moderate-income households across America to electrify their homes. According to Rewiring America, the HEEHRA will lower monthly energy costs for American families, improve indoor air quality, and cut carbon emissions. Although the maximum savings offered by various electrification initiatives vary, the HEEHRA rebate will cover 50% of the costs for moderate-income households for up to $14,000 and 100% of the costs for low-income households to electrify their homes. For the installation, there is a maximum contractor rebate of $500.

Image credit: Rewriting America

These rebates can be combined, but the most any one household can receive is $14,000.

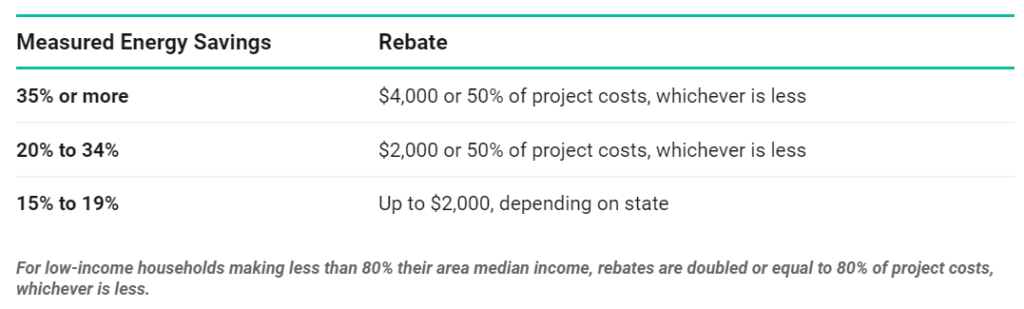

HOMES Rebate Program

Under the Home Owner Managing Energy Savings (HOMES) rebate, incentives are provided for home energy upgrades based on the following:

- Property type: Single-family or multifamily

- Percentage energy savings achieved

- Being considered a low-income household

Energy upgrades for single-family houses are eligible for rebates of $2,000 for energy savings of 20% to 35% and $4,000 for savings of over 35%. The reimbursement amount is capped at 50% of project costs in both situations. For households earning less than 80% of the regional median income, the HOMES rebate amount is doubled and is up to $8,000 for savings with over 35% and up to $4,000 for savings of 20–35%.

Am I qualified for the energy efficiency rebates?

Not all households will be eligible for HEEHRA rebates. The Inflation Reduction Act (IRA) reserves the energy efficiency and electrification incentives for families earning less than 150% of the area median income (AMI), as determined by the Department of Urban Housing and Development (HUD).

You must meet the following requirements to qualify for HEEHRA.

- Low-income households: Less than 80% of your area’s median family income

- Moderate-income households: 80% to 150% of your area’s median income for families

- Multifamily buildings: Above requirements apply to multifamily buildings with 50% or more LMI residents

If you’re not sure whether you qualify, you may contact the US Department of Housing and Urban Development (HUD).

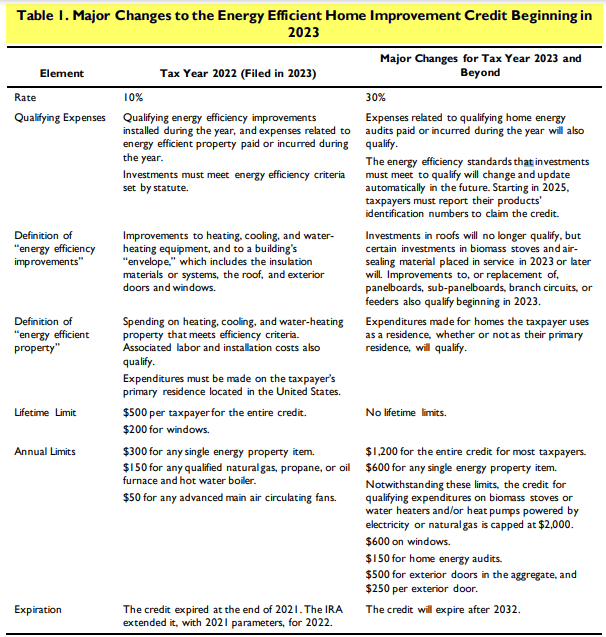

2023 Energy Efficiency Tax Credits

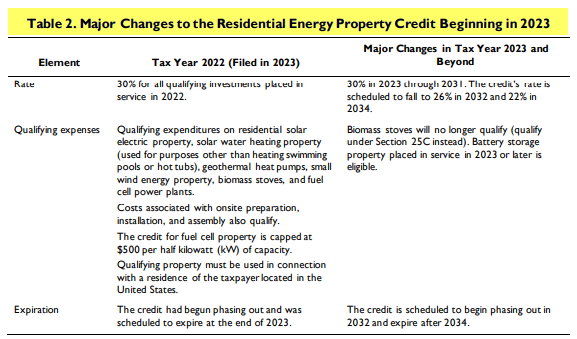

If you are not eligible for the energy efficiency rebates, the Inflation Reduction Act of 2022 (IRA) expanded and extended two nonrefundable tax credits intended to entice people to make investments in energy efficiency upgrades or green energy in their residences:

- Energy Efficient Home Improvement Credit (26 U.S. Code Section 25C) – which provides financial support for certain initiatives that lower household energy use; and

- Residential Clean Energy Credit (26 U.S. Code Section 25D) – which provides taxpayers’ homes with subsidies for investments in renewable energy production.

A tax credit does not lower the project’s purchase price, unlike a point-of-sale refund. Rather, you claim it when you submit your taxes, which may result in a larger refund or a lower tax bill.

Can I combine both tax credits and rebates?

Yes, qualified energy-efficient projects can receive both rebates and tax credits, although the Energy Efficient Home Improvement Tax Credit and HEEHRA Rebates are two distinct incentives made possible by the Inflation Reduction Act. However, you cannot combine the two rebate programs under the IRA. Any of the rebates may be combined with the 30% federal tax credit, but not both rebates (they are mutually exclusive).

______________________________________________________________________________________________________

Sources:

The Inflation Reduction Act Is Now Law—Here’s What It Means For You

How To Cash In On Billions In Green Home Improvement Tax Credits And Rebates`

Residential Energy Tax Credits: Changes in 2023

2022 HEEHRA Rebates: A Guide to the High-Efficiency Electric Home Rebate Act

High-Efficiency Electric Home Rebate Act (HEEHRA)

The New Federal Tax Credits and Rebates for Home Energy Efficiency

______________________________________________________________________________________________________

BSH Accounting is a Dallas Tax, Bookkeeping, and Accounting Firm that specializes in efficient advisory services for small business owners. Although we are a Dallas Accounting Firm, we have clients all over the United States.