What the CalSavers Act is All About

CalSavers, previously known as Secure Choice, is a retirement savings plan implemented by California which took effect last September 30, 2020. This retirement savings plan requires employers who have (5) five or more employeess to provide a private retirement plan or sign up with the state plan.

Calsavers’ objective is to help provide workers in California have access to retirement financial security.

CalSavers plan allows employers with a means to create an Individual Retirement Account (IRA) for every qualified employee. The plan comes with the following features:

- Auto payroll deductions at 5% and auto-escalation up to 8%.

5% standard deduction from the employee’s gross pay are automatically deducted from their payroll to contribute it to the plan. However, each employee can adjust their contributions to a higher or lower percentage. They can even opt-out of this retirement savings plan, provided they re-opt out proactively every two years.

This retirement plan offers auto-escalation which means that the employee contributions are auto-increased by 1% annually (up to 8%) provided they re-opt out proactively every two years.

- Annual contribution limits up to $6,000.

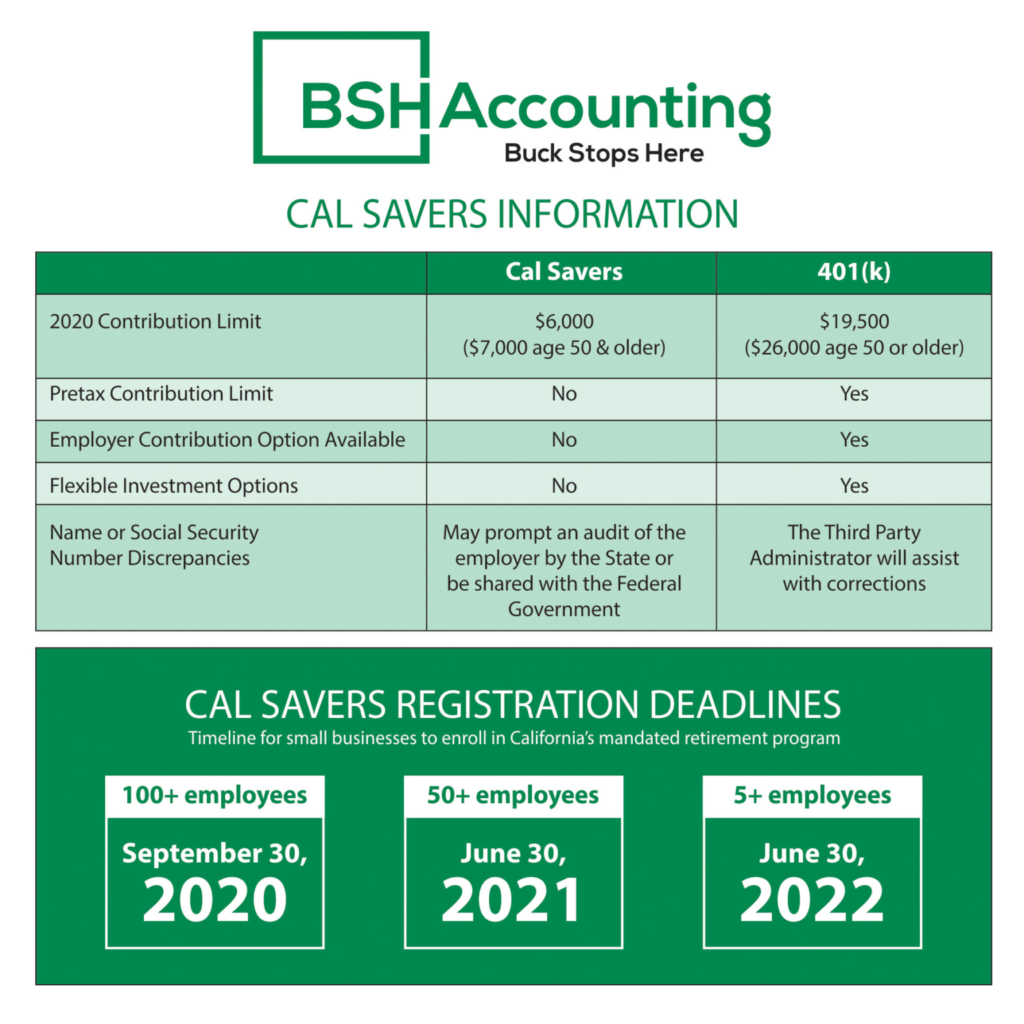

Calsavers offers a Roth IRA account which allows individuals under the age of 50 to have a maximum annual contribution limit of up to $6,000. Those who are over the age of 50 will still be able to contribute for an additional $1,000 for a total of $7,000.

- Limited to employees with a yearly income of less than $135,000.

An income ceiling is required for employees to participate in the Calsavers plan. The retirement plan is only available to employees with an income of less than $135,000 annually. However, those who make more than $135,000 annually can choose another retirement plan such as 401(k) which has no required income ceiling for participation. 403(b), SEP IRA, and SIMPLE IRA are also some of the other retirement plans to choose from.

The CalSavers plan participants will pay roughly between 0.825% and 0.95% of assets which will then be deducted from every employee’s account balance annually. No employer fees apply in the CalSavers plan and employers cannot make matching contributions.

The CalSavers deadline to register depends on the business size. The following are the deadlines:

Business with over 100 employees — September 30, 2020

Business with over 50 employees — June 30, 2021

Business with 5 or more employees — June 30, 2022

It is necessary that employers with Californian employees sponsor a retirement plan for their workers or sign up with the CalSavers plan with the corresponding deadline. Failure to comply with the Calsavers mandate could result to a fine of up to $750 for every eligible employee ($250 fee for every eligible employee – 90 days after notice of non-compliance, and $500 additional fee for every eligible employee – 180 days after notice of non-compliance).

Other states besides California are considering adopting similar plans.

Download this great guide from ADP Retirement Services

Sources:

CalSavers Retirement Savings Program

(https://edd.ca.gov/employers/calsavers.htm)

What You Need to Know About CalSavers’ June 30 Deadline

(https://www.guideline.com/blog/what-you-need-to-know-about-calsavers-june-30-deadline/)

Here is everything you need to know about CalSavers

(https://www.guideline.com/blog/here-is-everything-you-need-to-know-about-calsavers/)